美國股票分紅退稅

非美國居民 (NRA, non-resident alien) 在美國券商投資證券,且有遞交W-8ben表格的話,股息入帳時就會被預扣30%的稅

我目前只有公司配的股票, 因為股利所以被預扣了稅(NRA Withholding).

以下是我的紀錄,

有念頭想要扣稅已是4月中的事, 根據"When To File" in i1040nr.pdf:

"

Individuals. If you were an employee and received wages subject to U.S. income tax withholding, file Form 1040NR by the 15th day of the 4th month after your tax year ends. A return for the 2018 calendar year is due by April 15, 2019.

If you did not receive wages as an employee subject to U.S. income tax withholding, file Form 1040NR by the 15th day of the 6th month after your tax year ends. A return for the 2018 calendar year is due by June 17, 2019.

"

我被扣的不是跟wage有關, 所以期限應該是6月17日.

就試試看, 不行的話, 就當花錢買經驗. 在外商工作, 總有一天還是要碰到的.

申辦地點:

北部:

我把以下的文件 :

如果您在申請七週後仍未收到您的ITIN或其他國稅局信函,您可以致電國稅局1-800-829-1040免費電話,查詢您目前的申請辦理情況。

如果您不在美國,請致電267-941-1000(不是免費電話)。

以上步驟所依據的資訊, 附在以下供參考.

ITIN(Individual Taxpayer Identification Number),是美國國稅局針對非美國居民,而且有報稅要求的人士而專門設立的代碼。

使用W-7表格進行申請,獲得ITIN後就可進行非美國居民個人稅(1040NR)的申報。

您是否曾經收到美國臨時稅藉碼(TIN)或是員工辨別碼 (EIN)?請勾選No/ Do not know

ITIN身分證明文件 (建議使用護照):

一、將您的護照正本郵寄至美國稅務主管機關。您不需要附上回郵信封,此選項有護照寄失的風險。

二、郵寄公正過的護照復印件。此選項需將您的護照復印件提交給外交相關部門進行公證 。(此選項IRS美國稅務機關有可能不采用)

請將W-7表、有效的聯邦所得稅表(1042-S),您經過公證(notarized)或認證(certified)的passport。一起郵寄至以下地址:

Internal Revenue Service

Austin Service Center

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

如果你在整個稅務年度內滿足下述條件,則可以使用此簡化程序:

(1)非在美居住外國人。

(2)無從事過跟美國有關的貿易或者業務活動。

(3)收入跟美國的貿易或業務行為沒有直接關聯。

(4)美國收入所得稅在獲得收入時已全部被預扣。

(5)你填報1040NR的目的是為了退回預扣的所得稅。

報稅表單填寫

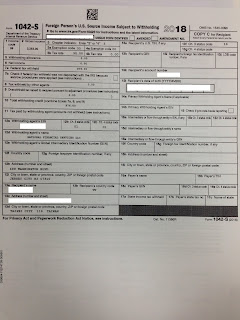

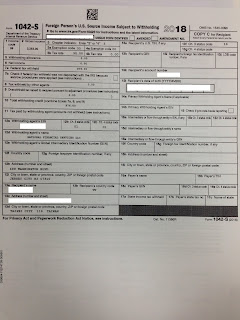

1)Form 1042S (券商寄發,每年三月券商寄發,六月十五日之前完成報稅程序)

2)Form 1040 NR(可自行下載)

Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30%.

The term NRA withholding is used in this area descriptively to refer to withholding required under sections 1441, 1442, and 1443 of the Internal Revenue Code.

Payments to all foreign persons, including nonresident alien individuals, foreign entities and governments, may be subject to NRA withholding.

For tax purposes, an alien is an individual who is not a U.S. citizen. Aliens are classified as nonresident aliens and resident aliens. This publication(Publication 519 (2018), U.S. Tax Guide for Aliens) will help you determine your status and give you information you will need to file your U.S. tax return.

美國券商必須在3月15日之前 (假日順延) 提供1042-S表格給NRA客戶,上面會列出NRA全年度的稅前所得 (Gross income)、所得類別 (Income code)、稅率 (Tax rate)、預扣稅款 (Federal Tax Withheld) 等關鍵信息,可據以計算應稅所得和已扣繳稅金 (相當於台灣的扣繳憑單)。券商會同時提供郵寄實體文件和下載PDF電子文件,兩者效力相同,但前者用平信寄,往往要等比較久才會收到。往來券商超過一個時,就要把全部券商的應稅收入(Gross Incomes)加總一併計算。 我們可以根據根據這份文件申報1040NR表格請求退稅。

2015年開始IRS(International Revenue Service,簡稱IRS)規定給客戶的1042-S必須和給IRS的版本 (Copy A) 內容完全一樣,每個戶頭、每種收入類別 (Income Code) 都需有單獨的1042-S表格,收入類別、戶頭比較多的話就會變成一大疊,但主要的欄位並沒有改變:

Income code 06代表的是股息(1042-S上的說明是Dividends paid by U.S. corporations-general),本來應該和帳目中的股息總和相同。不過,被預扣稅的股息當中有些是免稅的:

利息都是免稅,也不會有任何預扣稅。

退稅之前帳戶裡的現金收入來源如果排除賣出證券的收入,就只有股息、資本利得分配、利息三種:

這些免稅項目,只要我們能提出合理的依據,將原本歸類於應稅所得 (Income code 06) 的配息,再分類為免稅所得,即可藉此填報1040NR,要求IRS退稅。

如果1042-S總收入沒有超過免稅額,那麼按申報個人免稅額(personal exemption)就可以全額退稅.

美國2018年已取消個人免稅額( 2017年個人免稅額和2016同樣是 $4,050 USD ), 以10%起跳的累進稅率計算稅額,所以無法全額退稅。

只要應稅收入不是高達48萬美元以上就還是可以退到稅,只是應該是不可能再全額退稅 (計算方式詳Instructions for Form 1040NR末尾的簡表和公式)。

由於單純的外國投資人可以不報稅,而按規定報稅期限的2年內都可以申請退稅

所以2018的稅到2021/6/15才真正截止退稅申請 (需要主動報稅者的申報期限4/15之前應該更保險)。

以NRA身分在美國券商投資,其美國所得所需要繳的稅,會由券商從配息中直接扣除 (預扣稅 Withholding Tax),並交給美國國稅局 (IRS),所以NRA投資人拿到的收入都是稅後所得,不必報稅也不會有任何問題。報稅,其實只是為了退稅.

用1040NR表格.

美國人用社會安全碼, 外國人用ITIN碼.

ITIN是報稅的用途, 讓美國以一個代碼追蹤投資人的稅務.

申請ITIN要使用W-7 form(Application for IRS Individual Taxpayer Identification Number).

下載後可直接填寫, 然後印出第一頁(其他頁是說明)

個人資料要和護照上一樣, Identification Number勾選Passport.

"Supporting Documentation Requirements" in "Instructions for Form W-7":

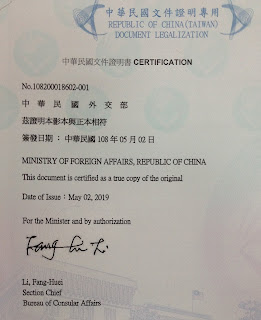

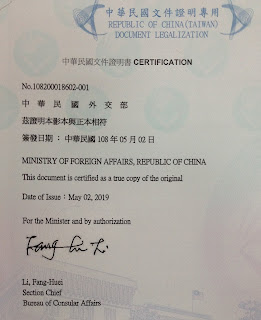

A certified document is one that the original issuing agency provides and certifies as an exact copy of the original document and contains an official stamped seal from the agency.

If you’re submitting a passport, or a certified copy of a passport from the issuing agency, no other documentation is required to prove your identity and foreign status.

然後至外交部對護照影本申請文書驗證:

向本局及外交部國內各辦事處申請出具「護照正影本相符」證明:

申請人親自辦理應備資料.

如何申請:

http://www.boca.gov.tw/ct.asp?xItem=4990&ctNode=748&mp=1

台北市中正區濟南路1段2之2號3~5樓

申請護照、簽證及文件證明櫃檯受理時間為週一至週五 上午:08:30 — 下午:17:00 (中午不休息,

此證明是為了申請 ITIN.

附件是一封信供參考:

把全部文件寄到美國:

申請 ITIN 必備的文件包括:外國人身分證明、需要申請 ITIN 的理由證明。後者對首次申請退稅者來講就是 1040NR和所需的附屬文件 (主要是1042-S)。

所以,用來申請ITIN的FORM W-7一定要在首次報税時,連同1040NR一起寄到FORM W-7的專屬收件地址 (而非一般報稅的收件地址),否則一定會被退件。

初次申請 ITIN ,連同報稅,請寄到:

第一次報稅的預計花費:

1. 護照影本與正本相符文件 => 400元

2. 國際快捷費用 (我一次寄三個年份的文件) => 390元

Answer:

If you lost your refund check, you should initiate a refund trace:

Call us at 800-829-1954 (toll-free) and either use the automated system or speak with an agent.

However, if you filed a married filing jointly return, you can’t initiate a trace using the automated systems. Download and complete the Form 3911, Taxpayer Statement Regarding Refund (PDF) or the IRS can issue you a Form 3911 to get the replacement process started.

Your claim for a missing refund is processed one of two ways:

If the check wasn't cashed, you'll receive a replacement check once the original check is canceled.

If the refund check was cashed, the Bureau of the Fiscal Service (BFS) will provide you with a claim package that includes a copy of the cashed check. Follow the instructions for completing the claim package. BFS will review your claim and the signature on the canceled check before determining whether they can issue you a replacement check. The BFS review can take up to six weeks to complete.

If you lost your IRS refund check (or failed to cash it in before the 1-year expiration date), call the IRS at 1-800-829-1954 to initiate a refund trace. The Bureau of Fiscal Service may need to review your claim before they can re-issue your IRS refund check, which can take up to 6 weeks to complete.

However, the IRS doesn't allow more than three direct deposits into the same bank account per tax year, so you may have no choice but to get a paper check. In addition, you may have other reasons for wanting a paper check. If your paper check goes missing, you can ask the IRS to trace it by calling (800) 829-1954, or by filling out Form 3911 (note that those who filed as married filing jointly need to start with the form).

The IRS will determine if the check was cashed. If it wasn't, then the agency will issue a replacement check. If it was cashed, then the agency will create a claims package that includes a copy of the endorsed, cashed check. Following a review of the information (including the signature on the back of the cashed check), the agency will decide whether or not to issue a replacement check. Expect this process, which is run through the U.S. Bureau of the Fiscal Service, to take about six weeks.

If you are a taxpayer with specific individual or business account questions you should contact the International Taxpayer Service Call Center by phone or fax. The International Call Center is operational Monday through Friday, from 6:00 a.m. to 11:00 p.m. (Eastern Time):

法國:+33 800、+33 805、+33 809

波蘭:+48 800

英國:+44 500、+44 800、+44 808

美國:+1 800、+1 866、+1 877、+1 888

台灣:+886 80

我目前只有公司配的股票, 因為股利所以被預扣了稅(NRA Withholding).

以下是我的紀錄,

2018退稅步驟

有念頭想要扣稅已是4月中的事, 根據"When To File" in i1040nr.pdf:

"

Individuals. If you were an employee and received wages subject to U.S. income tax withholding, file Form 1040NR by the 15th day of the 4th month after your tax year ends. A return for the 2018 calendar year is due by April 15, 2019.

If you did not receive wages as an employee subject to U.S. income tax withholding, file Form 1040NR by the 15th day of the 6th month after your tax year ends. A return for the 2018 calendar year is due by June 17, 2019.

"

我被扣的不是跟wage有關, 所以期限應該是6月17日.

就試試看, 不行的話, 就當花錢買經驗. 在外商工作, 總有一天還是要碰到的.

至外交部辦事處申請出具「護照正影本相符」證明

親自辦理應備資料:- 護照正本。(正本驗畢當場歸還)

- 倘申辦一份,請準備護照首頁個人資料影本三份

- 填妥之文件證明申請表

申辦地點:

北部:

- 台北市中正區濟南路1段2之2號3~5樓

- 週一至週五上午 08:30 — 下午 17:00 (中午不休息), 申辦護照櫃檯每週三延長收件及發照時間至20:00止

申請ITIN代碼(填寫W-7 Form)

申請退稅(填寫104NR Form)

寄出所有相關的文件

我把以下的文件 :

- 稅表 104NR和1042-S.

- W-7表

- 身份證明與外籍人士身份文件 護照影本2張籍與正本相符的證明

Internal Revenue Service Austin Service Center ITIN Operation P.O. Box 149342 Austin, TX 78714-9342 USA

等待ITIN代碼的通知及退稅支票

如果您在申請七週後仍未收到您的ITIN或其他國稅局信函,您可以致電國稅局1-800-829-1040免費電話,查詢您目前的申請辦理情況。

如果您不在美國,請致電267-941-1000(不是免費電話)。

美股退稅問題

一、退稅作業流程

ITIN(Individual Taxpayer Identification Number),是美國國稅局針對非美國居民,而且有報稅要求的人士而專門設立的代碼。

使用W-7表格進行申請,獲得ITIN後就可進行非美國居民個人稅(1040NR)的申報。

二、申請ITIN號碼

W-7表格填寫例子:

您是否曾經收到美國臨時稅藉碼(TIN)或是員工辨別碼 (EIN)?請勾選No/ Do not know

ITIN身分證明文件 (建議使用護照):

一、將您的護照正本郵寄至美國稅務主管機關。您不需要附上回郵信封,此選項有護照寄失的風險。

二、郵寄公正過的護照復印件。此選項需將您的護照復印件提交給外交相關部門進行公證 。(此選項IRS美國稅務機關有可能不采用)

請將W-7表、有效的聯邦所得稅表(1042-S),您經過公證(notarized)或認證(certified)的passport。一起郵寄至以下地址:

Internal Revenue Service

Austin Service Center

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

三、1040NR申請退稅

如果你在整個稅務年度內滿足下述條件,則可以使用此簡化程序:

(1)非在美居住外國人。

(2)無從事過跟美國有關的貿易或者業務活動。

(3)收入跟美國的貿易或業務行為沒有直接關聯。

(4)美國收入所得稅在獲得收入時已全部被預扣。

(5)你填報1040NR的目的是為了退回預扣的所得稅。

報稅表單填寫

1)Form 1042S (券商寄發,每年三月券商寄發,六月十五日之前完成報稅程序)

2)Form 1040 NR(可自行下載)

NRA Withholding

Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30%.

The term NRA withholding is used in this area descriptively to refer to withholding required under sections 1441, 1442, and 1443 of the Internal Revenue Code.

Payments to all foreign persons, including nonresident alien individuals, foreign entities and governments, may be subject to NRA withholding.

For tax purposes, an alien is an individual who is not a U.S. citizen. Aliens are classified as nonresident aliens and resident aliens. This publication(Publication 519 (2018), U.S. Tax Guide for Aliens) will help you determine your status and give you information you will need to file your U.S. tax return.

Instructions for Form 1040NR

1042-S表格

美國券商必須在3月15日之前 (假日順延) 提供1042-S表格給NRA客戶,上面會列出NRA全年度的稅前所得 (Gross income)、所得類別 (Income code)、稅率 (Tax rate)、預扣稅款 (Federal Tax Withheld) 等關鍵信息,可據以計算應稅所得和已扣繳稅金 (相當於台灣的扣繳憑單)。券商會同時提供郵寄實體文件和下載PDF電子文件,兩者效力相同,但前者用平信寄,往往要等比較久才會收到。往來券商超過一個時,就要把全部券商的應稅收入(Gross Incomes)加總一併計算。 我們可以根據根據這份文件申報1040NR表格請求退稅。

2015年開始IRS(International Revenue Service,簡稱IRS)規定給客戶的1042-S必須和給IRS的版本 (Copy A) 內容完全一樣,每個戶頭、每種收入類別 (Income Code) 都需有單獨的1042-S表格,收入類別、戶頭比較多的話就會變成一大疊,但主要的欄位並沒有改變:

股息 (Dividend,Income code 06, 37, 01)

非美國居民 (NRA) 的投資人,且有遞交W-8ben給券商的話,只要有股息收入,入帳時就會被預扣30%的稅。Income code 06代表的是股息(1042-S上的說明是Dividends paid by U.S. corporations-general),本來應該和帳目中的股息總和相同。不過,被預扣稅的股息當中有些是免稅的:

- Foreign source income:國外來源收入

- Return of Capital (ROC):本金(非股利,不算是收入)返還,在稅務文件中則稱為Non-Dividend Distributions,這類配息並非來自於股利,如券商主動退還稅金 (Repaid),會被改列於 Income code 37

- Qualified interest income (QII) :即利息相關的股息,如券商主動退還稅金,可能會被改列於Income Code 01 (Interest paid by U.S. obligors-general)

資本利得分配 (Capital gain distribution, Income code 06, 36)

此類配息(distribution)並非來自基金持有證券之股息(dividend),而是來自基金賣出資產的獲利。利息(Interest, Income code 01, 29)

利息都是免稅,也不會有任何預扣稅。

收入總和核對

退稅之前帳戶裡的現金收入來源如果排除賣出證券的收入,就只有股息、資本利得分配、利息三種:

1042-S 收入總和 = 股息 + 長短期資本利得分配 + 利息 = 交易紀錄配息總和

這些免稅項目,只要我們能提出合理的依據,將原本歸類於應稅所得 (Income code 06) 的配息,再分類為免稅所得,即可藉此填報1040NR,要求IRS退稅。

如果1042-S總收入沒有超過免稅額,那麼按申報個人免稅額(personal exemption)就可以全額退稅.

退稅

美國2018年已取消個人免稅額( 2017年個人免稅額和2016同樣是 $4,050 USD ), 以10%起跳的累進稅率計算稅額,所以無法全額退稅。

只要應稅收入不是高達48萬美元以上就還是可以退到稅,只是應該是不可能再全額退稅 (計算方式詳Instructions for Form 1040NR末尾的簡表和公式)。

由於單純的外國投資人可以不報稅,而按規定報稅期限的2年內都可以申請退稅

所以2018的稅到2021/6/15才真正截止退稅申請 (需要主動報稅者的申報期限4/15之前應該更保險)。

以NRA身分在美國券商投資,其美國所得所需要繳的稅,會由券商從配息中直接扣除 (預扣稅 Withholding Tax),並交給美國國稅局 (IRS),所以NRA投資人拿到的收入都是稅後所得,不必報稅也不會有任何問題。報稅,其實只是為了退稅.

NRA報稅

用1040NR表格.

首次報稅時如何申請ITIN(Individual Taxpayer Identification Number

美國人用社會安全碼, 外國人用ITIN碼.

ITIN是報稅的用途, 讓美國以一個代碼追蹤投資人的稅務.

如何填寫

申請ITIN要使用W-7 form(Application for IRS Individual Taxpayer Identification Number).

下載後可直接填寫, 然後印出第一頁(其他頁是說明)

個人資料要和護照上一樣, Identification Number勾選Passport.

"Supporting Documentation Requirements" in "Instructions for Form W-7":

A certified document is one that the original issuing agency provides and certifies as an exact copy of the original document and contains an official stamped seal from the agency.

If you’re submitting a passport, or a certified copy of a passport from the issuing agency, no other documentation is required to prove your identity and foreign status.

然後至外交部對護照影本申請文書驗證:

向本局及外交部國內各辦事處申請出具「護照正影本相符」證明:

申請人親自辦理應備資料.

如何申請:

http://www.boca.gov.tw/ct.asp?xItem=4990&ctNode=748&mp=1

台北市中正區濟南路1段2之2號3~5樓

申請護照、簽證及文件證明櫃檯受理時間為週一至週五 上午:08:30 — 下午:17:00 (中午不休息,

- 護照正本。(正本驗畢當場歸還)

- 倘申辦一份,請準備護照首頁個人資料影本三份,其中二份留於本局或外交部國內各辦事處存卷(護照需彩色或黑色影印應視文件需用機關規定,建議成年人應先簽名後再行影印申辦)。申辦份數增加,請自行加備影本。

- 填妥之文件證明申請表。(下載請至「下載文件證明申請表」)

- 收費方式。一般正常件收費(二個工作天),每件新臺幣400元。

此證明是為了申請 ITIN.

附件是一封信供參考:

The completed W-7 form and a certified copy of my passport are enclosed. This copy has been certified as a true copy of the original. It was certified by Chia-Ming Chao, section chief , Southwestern Taiwan Branch Office, Ministry of Foreign Affairs, Republic of China, signed on April 24, 2013. Please feel free to contact me by email ([my email address:jwhei@**********]) . Thank you for your kind assistance.

把全部文件寄到美國:

- Form W-7

- 中華民國護照基本資料頁影本與正本相符證明

- Form 1042-S中的Copy C Form 1042-S中的Copy C,下方附註有"Attach to any Federal tax return you file"

- 該年度的 1040NR

申請 ITIN 必備的文件包括:外國人身分證明、需要申請 ITIN 的理由證明。後者對首次申請退稅者來講就是 1040NR和所需的附屬文件 (主要是1042-S)。

所以,用來申請ITIN的FORM W-7一定要在首次報税時,連同1040NR一起寄到FORM W-7的專屬收件地址 (而非一般報稅的收件地址),否則一定會被退件。

初次申請 ITIN ,連同報稅,請寄到:

Internal Revenue Service

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342 USA

第一次報稅的預計花費:

1. 護照影本與正本相符文件 => 400元

2. 國際快捷費用 (我一次寄三個年份的文件) => 390元

Question

I lost my refund check. How do I get a new one?

Answer:

If you lost your refund check, you should initiate a refund trace:

Call us at 800-829-1954 (toll-free) and either use the automated system or speak with an agent.

However, if you filed a married filing jointly return, you can’t initiate a trace using the automated systems. Download and complete the Form 3911, Taxpayer Statement Regarding Refund (PDF) or the IRS can issue you a Form 3911 to get the replacement process started.

Your claim for a missing refund is processed one of two ways:

If the check wasn't cashed, you'll receive a replacement check once the original check is canceled.

If the refund check was cashed, the Bureau of the Fiscal Service (BFS) will provide you with a claim package that includes a copy of the cashed check. Follow the instructions for completing the claim package. BFS will review your claim and the signature on the canceled check before determining whether they can issue you a replacement check. The BFS review can take up to six weeks to complete.

How do I replace a lost or damaged tax refund check?

If you lost your IRS refund check (or failed to cash it in before the 1-year expiration date), call the IRS at 1-800-829-1954 to initiate a refund trace. The Bureau of Fiscal Service may need to review your claim before they can re-issue your IRS refund check, which can take up to 6 weeks to complete.

Tracing a Refund Check That Has Gone Missing

The easiest and one of the best ways for you to receive your tax refund is through direct deposit (electronic transfer of funds directly into your bank account). This also is the safest method, since you don't need to worry about a paper check getting lost in the mail, misplaced once you have it in hand, or stolen.However, the IRS doesn't allow more than three direct deposits into the same bank account per tax year, so you may have no choice but to get a paper check. In addition, you may have other reasons for wanting a paper check. If your paper check goes missing, you can ask the IRS to trace it by calling (800) 829-1954, or by filling out Form 3911 (note that those who filed as married filing jointly need to start with the form).

The IRS will determine if the check was cashed. If it wasn't, then the agency will issue a replacement check. If it was cashed, then the agency will create a claims package that includes a copy of the endorsed, cashed check. Following a review of the information (including the signature on the back of the cashed check), the agency will decide whether or not to issue a replacement check. Expect this process, which is run through the U.S. Bureau of the Fiscal Service, to take about six weeks.

International Services

If you are a taxpayer with specific individual or business account questions you should contact the International Taxpayer Service Call Center by phone or fax. The International Call Center is operational Monday through Friday, from 6:00 a.m. to 11:00 p.m. (Eastern Time):

Tel: 267-941-1000 (not toll-free)

Fax: 267-466-1055 (for international tax account issues only)

Get Refund Status

Please enter your:- Social Security Number/ITIN

- your Filing Status

- the refund amount as shown on your tax return

IRS: Get Transcript Online

我可以在 Skype 中撥打免費電話嗎?

是的,使用撥號鍵台在 Skype 中輸入免費電話。 支援以下國家/地區和數量範圍,所有使用者均為免費:法國:+33 800、+33 805、+33 809

波蘭:+48 800

英國:+44 500、+44 800、+44 808

美國:+1 800、+1 866、+1 877、+1 888

台灣:+886 80

留言